If you are looking for information on Benetrends, Benetrends Rainmaker, Benetrends Rainmaker Plan, Benetrend, Benatrend, Benatrends, self directed IRA, self directed 401k rollover plans, self guided IRA, franchise funding, business purchase, buy real estate using retirement funds, IRA rollover, 401k, 403b, no taxes or penalties, then you have come to the right place.

The Rainmaker™ Plan

Bringing franchise and business ownership

dreams to life using your retirement funds

Welcome to BeneTrends. As a company, we help individuals create substantial revenue with the money they've saved over the years. Using our Rainmaker Plan, you can use the funds in your 401K, IRA, profit-sharing, or annuity plans to open a business - and create revenue - without taxes or penalties.

Welcome to BeneTrends. As a company, we help individuals create substantial revenue with the money they've saved over the years. Using our Rainmaker Plan, you can use the funds in your 401K, IRA, profit-sharing, or annuity plans to open a business - and create revenue - without taxes or penalties.

It only seems fitting that you should be rewarded for good saving habits. After all, you planned well, you did the right thing - you saved for your future.

But tax laws in America prevent savers from dipping into their 401K, IRA, profit-sharing, or annuity plans. In fact, in many states, you'll lose more than 50% of your funds in taxes and penalties, just for accessing the rainy-day savings you've worked so hard to accumulate.

BeneTrends was founded to help you avoid all of that. We've developed a perfectly legal, perfectly simple approach to help you create revenue with your savings. Our plan allows you to release the money in your retirement funds and use it for a fresh start in business - without penalty, and without taxes.

We started BeneTrends specifically to help people like you get that fresh start. Many people have been affected by downsizing or outplacement, and find themselves with money tied up in a retirement accounts while looking for ways to become their own bosses. For a small investment in the help BeneTrends can provide, you can save over a fortune in taxes on your money and use it to pursue the American dream. You can use the money to purchase a franchise, buy an existing business, or start your own entrepreneurial venture. And you won't lose a penny by doing so. Our Rainmaker Plan may be just what you need to begin your bright new future. A future you control.

If this sounds too good to be true, then we invite you to talk to hundreds of new business owners who have benefited from our plans. For more than 15 years, we've helped savers much like you start their own companies using their retirement funds, without distributions, penalties, taxes, or the use of loans.

At BeneTrends, we work together as a team to help you realize your dreams of starting a business. Together, we provide you with all of the information you'll need to understand the features and benefits of the Rainmaker Plan, and how it will work for you. It's our style - and our mission - to work hand-in-hand with you, walking you through each step of the process. We're committed to excellence and efficiency, and you'll be pleasantly surprised to find that the process can be handled entirely through the mail. We'll handle all of the paperwork for you. So you can focus on what's really important: building the business you've always wanted.

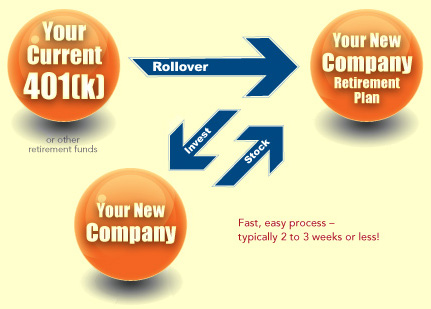

With our help, you can use your 401(k), 403 (b), Pension, profit sharing, IRA rollover or other retirement plan to finance the purchase of a franchise or as start-up capital for your own business or to purchase business property with no taxes, no penalties, no loan repayment and no hassle.

With our help, you can use your 401(k), 403 (b), Pension, profit sharing, IRA rollover or other retirement plan to finance the purchase of a franchise or as start-up capital for your own business or to purchase business property with no taxes, no penalties, no loan repayment and no hassle.

This can be done without distributions, taxes, penalties, or the use of loans. Your own money can be used as venture capital to avoid loans, fees and interest. These transactions are clearly within the letter of the law as spelled out in the Employee Retirement Income Security Act of 1974 (ERISA), and we have more than twelve years experience setting up Rainmaker Plans and have never had a problem with the IRS-there is no way for there to be future problems-this plan is laid out in the law and BeneTrends will obtain a letter approving the use of these funds in this way.

Build for the future - invest in yourself.

A business of your own may well be your best retirement plan. With Rainmaker, you can use your retirement funds as an initial business investment, and build on them year after year. After all, an investment in yourself is an investment you can believe in.

Plan for security - without using the roof over your head.

Lots of small business owners start out by borrowing against their homes. With the Rainmaker Plan, you can open a business without ever touching the home equity you worked so hard to build.

The information presented may have changed since first published. We recommend that you always verify fees, investment amounts and offers with the business opportunity directly prior to making a decision to invest.